Now I know you’re interested in results, and I’m going to share some with you later this week, but…

Today, instead of just showing you how many more strategies I’ve built since then, I thought you might be interested to know about some alternative ways to apply the Breakout Masterclass that can improve your results even further.

You see, the framework in the Breakout Masterclass is not just for creating intraday breakout strategies, it can be used to build other types of strategies too.

Why is that important?

- Well, in some markets it can be difficult to build intraday strategies. They don’t have enough movement during the day to overcome transaction costs and slippage, so you need to turn to other techniques that suit that particular market,

- Some traders aren’t interested in daytrading strategies and want to take trades that last longer, perhaps a few days to a few weeks,

- Or some traders have strategies that are Long only, which could be very dangerous in the upcoming Bear market,

- And of course, trading different types of strategies can be great for diversification too.

Anyway, there were some discussions about swing trading strategies in the private Breakout Masterclass community forum, so I decided to test the Breakout Masterclass smart code to build swing strategies.

The result?

Well, I’m glad to say that it worked nicely.

Using the Breakout Masterclass framework (which has a much more extensive Smart Code than the emini course), I was able to build a number of small portfolios very quickly.

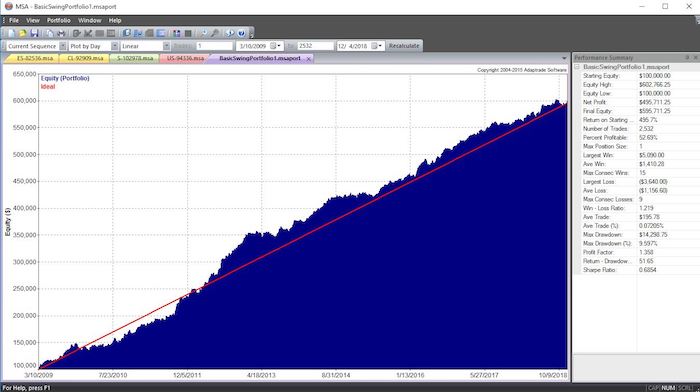

Here’s one of the portfolios, which includes just 4 swing strategies, in the Emini S&P 500 (ES), Crude Oil (CL), Soybeans (S) and Bonds (US) markets (all trades are from Walk Forward Out Of Sample results):

Image courtesy of Market System Analyzer

So you can see that even with just 4 uncorrelated Swing strategies you can produce portfolios with a smooth and consistent equity curve, and the Breakout Masterclass is an excellent option for creating Swing strategies. (We have an Advanced Swing program being released in the next few months too, which builds on top of the Breakout Masterclass framework so will only be available to Masterclass students.)

Also, the Smart Code included in the Breakout Masterclass is fully open and easily extendable, so you can quickly add your own ideas into the mix.

In fact, some of the Breakout Masterclass students are having excellent results in applying the Masterclass process in unique ways.

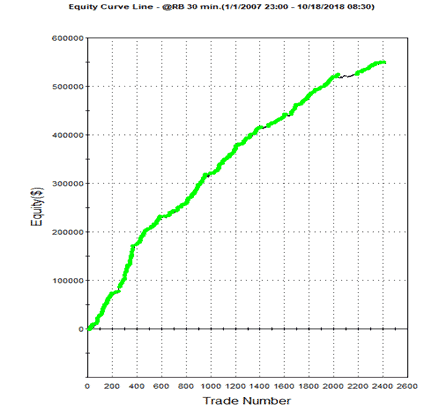

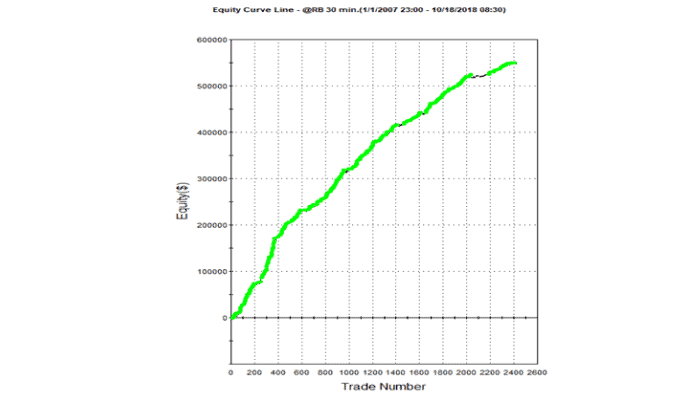

For example, Breakout Masterclass student Alan (who was on this BTA podcast episode), shared some of his research with the rest of the Masterclass students in the December coaching call. By applying the Masterclass framework in a totally unique way, Alan was able to build a low-correlated portfolio with outstanding results:

If you’re interested in knowing more about how you can build robust trading strategies with the Breakout Masterclass, click here for more details.

Happy trading for 2019!

Andrew

7 Proven Tips to Build Profitable Breakout Strategies FAST

✓ Key components to building better breakout strategies faster than ‘normal’

✓ Key components to building better breakout strategies faster than ‘normal’

✓ The most common mistakes breakout traders often make that costs them money – don’t let these catch you out

✓ How to choose the best markets and timeframe for quicker and more consistent results

✓ The shockingly simple technique to fast-track your breakout trading progress in just days

![[VIDEO] The no.1 reason why I trade futures only](https://bettertraderacademy.com/wp-content/uploads/2019/02/18feb19_v3-min.png)

![[VIDEO] How to improve trading entries](https://bettertraderacademy.com/wp-content/uploads/2019/02/22feb-video-min.png)

![[VIDEO] My #1 hedge fund secret](https://bettertraderacademy.com/wp-content/uploads/2019/04/1apr19-min.png)