Yet, the remaining 1% of the time, they can bring some truly remarkable results.

And I believe you’ll really like the one I’m going to share with you because it’s easy to implement and the results are self-evident.

But first, let me share what I’ve been doing the last 5 months in trading.

My hedge fund partner in charge of new money acquisition had a bunch of talks with big banks all over Europe.

Things were going pretty well, but a pretty tough request came from him:

“We need to launch another investment program (CTA 2), which will fully hedge the currently running one (CTA 1)”.

In other words:

Create another program with correlation as close to ZERO (!) as possible.

This sounded crazy, I know.

But it was what it was, so my hedge fund team got to work.

Now, understand this. Yes, we do have hundreds of super-robust trading strategies in our vast database. Among the vast majority of futures markets (and some stocks and ETFs).

But they’re all breakout strategies because that’s my speciality.

And it’s got its limits, obviously.

Because if we need to create another investment trading program with correlation to the first one as close to zero as possible, then the first logical option sounds like to build mean-reversion strategies.

It makes sense – what else could “hedge” breakout trading signals better than mean-reversion signals?

Unfortunately, we didn’t have any mean-reversion strategies.

Zero. Nada. Nothing.

So, we had to try different ways.

And after endless modeling (including one complete remake of the CTA 2 program just a few days before its launch), the solution revealed to be a super-simple one.

So simple, that I was shocked when I saw the results.

And it was this:

Simply build one program on day trading breakout strategies and the second one on swing breakout strategies.

And that was it.

The first program (CTA 1) has already been built on day trading strategies mainly.

So, the task was to use swing strategies only for the second one (CTA 2).

We even used some overlapping markets (like some indexes, energies and grains we have in both programs). Yet, whenever we combined a day trading version with a swing version…

…we immediately got a very favorable correlation.

So, after we completed the CTA 2 program based on swing strategies, we achieved…

…staggering correlation of just 2.4% (which is nearly zero).

That was it.

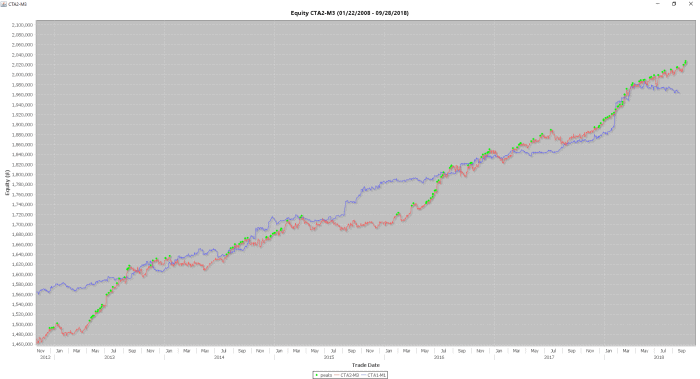

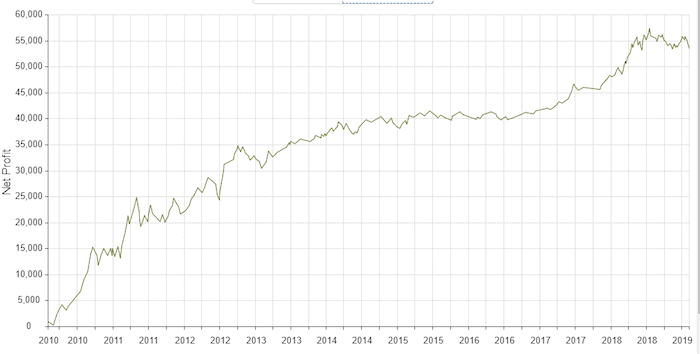

Now, here are two images.

This one shows the equity of the CTA 1 program (blue) and the equity of the CTA 2 program (red) in the same chart. The very low correlation is already obvious from a glance.

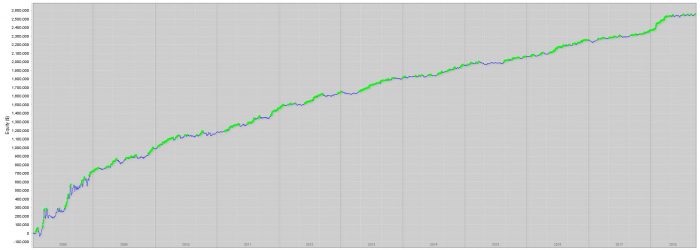

And here is what happens when both programs (equities) are combined into one:

So, here’s the simple hack to super boost your equity:

Combine and balance day trading strategies with swing strategies.

And diversify yourself among as many different markets as possible.

That’s it.

All the strategies for both programs were built with the process in the Breakout Strategies Masterclass.

Some of the strategies have been further improved with the Market Internals techniques.

And some of the Smashing False Breakouts techniques were implemented too.

100% of the strategies are breakout strategies. If you are new to breakout trading, I recommend the FREE 14-day breakout challenge.

Happy trading!

Tomas

Stop False Breakouts from Destroying Your Trading Account

✓ How false breakouts are the biggest leak of money for breakout traders, including Futures, Stocks, FX and ETFs

✓ How much money false breakouts could actually be costing you – without you even realizing it

✓ A comprehensive deconstruction of timing – enter breakout trades at the right time and stop costly breakout trading mistakes

✓ 4 proven approaches to slashing false breakouts today – stop them from stealing your money and eating all your profits!

![[VIDEO] What are you working so hard for?](https://bettertraderacademy.com/wp-content/uploads/2019/07/22.jul-FI-700px-min.png)