How can one “reinvent” himself? What does that even mean?

Does it mean I need to put myself in a trash bin and start “inventing” myself from the ground up again?

And how am I even supposed to do that?

At the time, it sounded like a load of B.S….

But then, something happened.

One day, I was sitting with another trader, a friend I had known for a long, long time. We were talking about our trading journeys, all those long years with the markets, and what we had to learn (so far) to keep up with the markets. And of course, after an hour or so, the talk turned to my hedge fund.

My friend knew how much I used to be scared by the idea of launching a hedge fund. How much I was afraid of all that responsibility and pressure. And how much reluctance I had to even consider such an idea. Yet, one day… I did it anyway.

So, my friend was a bit puzzled by that and naturally, he asked me:

“What changed that all of a sudden you agreed to launch your own hedge fund”?

And as soon as he asked, I immediately replied, somehow automatically, without even thinking:

”I got inspired and driven by the idea of REINVENTING myself”.

I was surprised by my answer and I had no idea where that even came from. But it was 100% TRUE.

When I look back, I realize that this is exactly what had to happen for me to finally get the confidence to do it. To launch my own hedge fund, I had to REINVENT my way of thinking about money. About portfolios. About risk management. And even about responsibility.

And that reinvention keeps going on today.

I still have to keep REINVENTING how I think about money. About trading. About strategies. About risk-management. And just lately, I had to reinvent how I think about TRADING EXITS too.

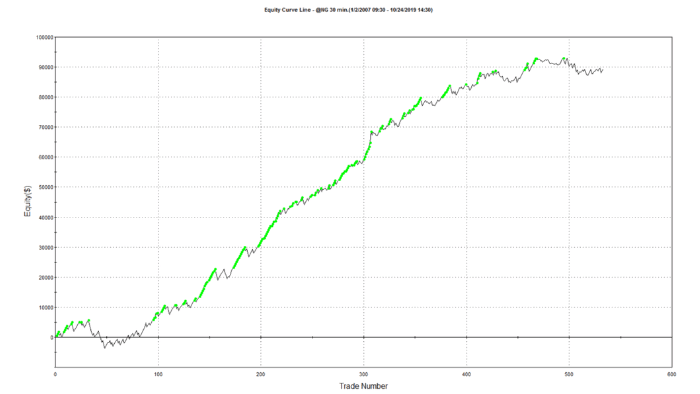

Over the last few months, my Hedge Fund team has been doing extensive research across thousands of trading strategies, to determine what exits work best. To be honest, I was shocked with what they found…

Some of the results were completely unexpected…

But what I realized is, that…

…reinventing your thinking about trading EXITS is actually where MUCH MORE money can be made.

This research revealed a totally new direction for our Hedge Fund to extract MORE money from the markets.

So, I again was pushed to REINVENT MYSELF IN ANOTHER TRADING AREA:

And I recommend you to do the same.

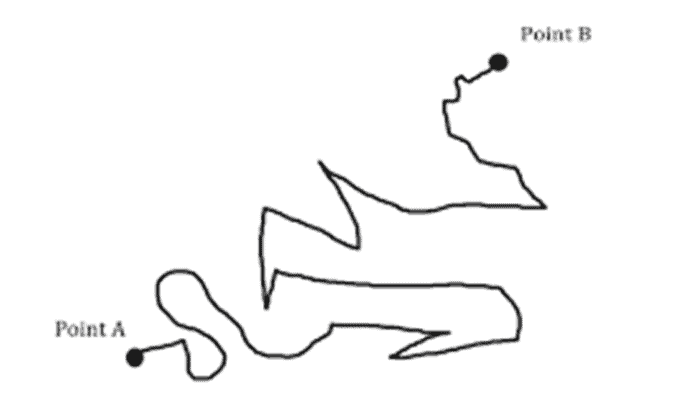

If you want to reinvent yourself, or even just evolve and mature as a trader…

… start paying MUCH MORE attention to exits. Put time into researching and testing different exit concepts, and I’m confident you’ll be rewarded with better trading performance.

And if you prefer to shortcut the process of “reinventing yourself as a trader” and get access to the results of my Hedge Fund research on exits…

…in the upcoming issue of the Empowered Trader club I share 3 “Big Money Exits” traders can use to extract more profits from the markets.

If you’re already a member of the Empowered Trader club, look out for your copy of this issue in the first week of May.

If you’re not an Empowered Trader member yet (or don’t even know what it’s about), you can find more details here.

Happy trading,

Tomas

![[Automated trading] What’s stopping you?](https://bettertraderacademy.com/wp-content/uploads/2018/04/83770750_m-min-e1542143263854.jpg)