And not only in trading – but in real life too.

I’m pretty sure that at least one of the many traders I know has checked the odds of dying in a plane crash before boarding a flight. (which according to the Internet is 1 in 205,552).

Or, the odds of getting attacked by a shark before entering the water (which is, allegedly, 1 in 3,748,067).

Or how about…. the odds of being injured by a toilet before you go… well, you know what! (For your information, according to the internet, it is just 1 in 10,000).

Now, I know some people could think traders are a bit “weird” in their obsession with odds and probabilities. But from a trading perspective, we simply want to manage and reduce any potential dangers. Besides, that’s what risk-management is all about, right?

But have you ever considered this potential risk:

How much are you controlling the odds of being hurt by market GAPS?

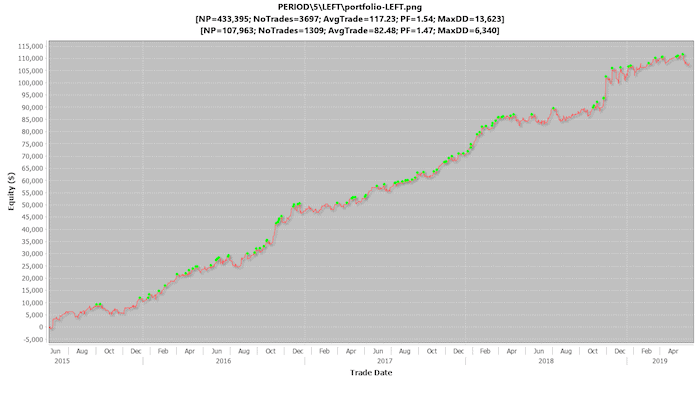

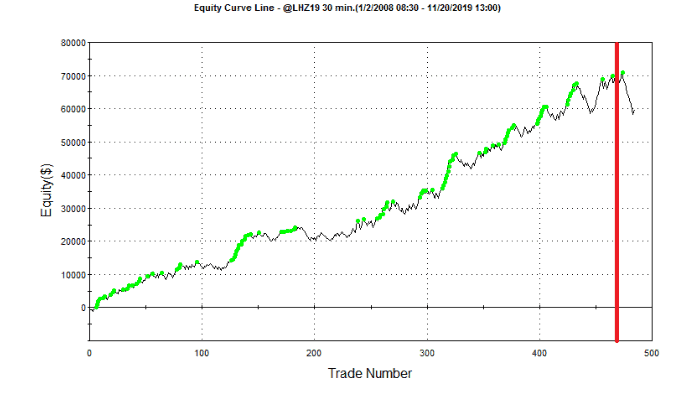

Yes, market gaps can hurt any trader. Gaps can lead to skewed/misleading data, produce erratic indicator behavior (which can be very misleading), and can create false, early or late trade signals.

It’s not unusual for a trader to lose a small fortune just because of market gaps and their unpredictability and distortion of trading charts and indicators!

The probability of gaps happening is almost CERTAIN, however most traders do nothing to mitigate this risk – because they simply do not know HOW!

Fortunately, there IS a way to get this kind of risk under control, and that is…

Implementing the “mind the gap” technique!

This is a technique I’ve been working on for the last few months, and it can help you to manage the impact of gaps much better.

Check it out, especially if you’d like to improve things like false market signals, or unreliable trading indicators.

And if you´re not an Empowered Trader Club member yet (or don’t even know what it’s about), you can find more details here.

Happy trading,

Andrew