We’re living in a trading ‘super-age’ and very few people even realize it.

When I talk to traders, a lot of them seem to be negative and complaining.

About markets. Brokers. Software. Data. Volatility. Latency. Slippage. Slow progress. Legislation. Occasional technical challenges and inconsistencies. And a bunch of other stuff.

Yet, the truth is – it has never been easier to become a full-time trader.

Especially the last few years, because we’re experiencing a truly massive acceleration of accessibility to cutting edge technology. Yet, we appreciate it too little.

Perhaps it is because of forgetfulness of how things used to be.

Or perhaps most traders are too new in this business, and they don’t have an idea.

So, let me share with you something about the “old days”.

First, when I started day trading more than 10 years ago, I used to pay up to 1,000 USD monthly just for market data.

Yes, that’s correct. At that time, live market data was very expensive and just a few companies offered it. Often, you had to take them with their own charting package, which alone could cost 200-500 USD per month to lease. It was very easy to pay up to 1,000 USD monthly just for the ‘privilege’ to have online access to the markets. And to have the ability to plot and perform any kind of technical analysis.

Today, we pay nearly nothing for everything, including market data, internet connection (which used to be billed by the amount of data transferred), and cutting-edge charting and trading software. In fact, we probably spend more money per week on our Starbucks lattes, than on all the cool stuff that allows us to trade.

Second, when I assembled my first tough robustness testing procedure, it took me up to 3 days to test just one strategy.

I have to smile a little (in a good, positive way) when Breakout Strategies Masterclass students have long discussions on how to make the ‘BOS Smart Code’ (part of the masterclass) more speed-efficient. Although I like and appreciate their enthusiasm, we’re talking about shaving a few seconds, or a few minutes off the process.

In “the old days”, it used to take me days to do what now takes just 15 minutes!

When I first assembled my robustness testing procedure, it took me up to 3 days to evaluate just 1 (!) single strategy. (Note: I admit it is computationally demanding, as it is one of the toughest robustness procedures in the industry). At that time, computers and high-end CPUs were very expensive. And still very slow compared to today’s standards. Plus platforms like TradeStation used to work with only 1-core anyway! So I had to learn to be very patient and wait days for everything.

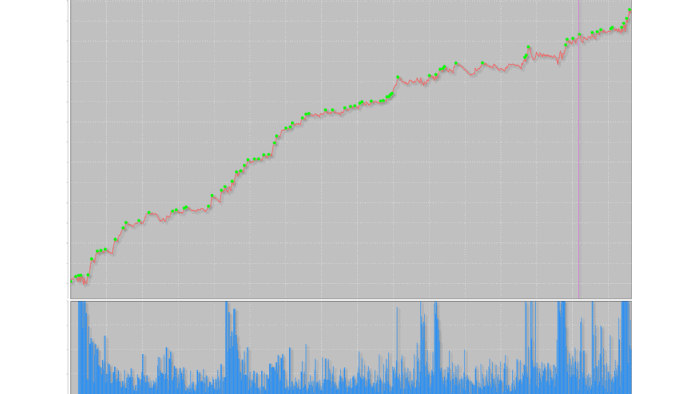

Today, I can perform even more extensive version of the robustness testing procedure literally in a few minutes.

Or develop hundreds of great breakout strategies overnight, like our students.

And lastly, when I first started trading fully automatically, I still had to sit in front of the computer for 8 hours a day.

Yes, that is true.

The technology was not as reliable as it is today.

And mainly, Virtual Private Servers or a server hosting service used to be way too expensive.

So one only had the option to monitor automated strategies personally. Which kind of negated some of the purpose of becoming an automated trader. (Which is to have more free time).

Today, I can run my own hedge fund without even seeing market data during the day. It is easy and cheap to arrange everything remotely. We can use outstanding services for nearly nothing. And deploy a lot of monitoring technology. We can even access anything through the mobile phone at any time.

So, the point is:

We truly are living in a trading ‘super-age’, and we should be grateful for that.

Deeply grateful.

It is much better and more efficient to start taking full advantage of what we DO have and CAN DO, instead of complaining about what we DON’T have and CAN’T DO.

We already have more than enough to become successful traders.

And it’s available now.

Happy trading,

Tomas

7 Proven Tips to Build Profitable Breakout Strategies FAST

✓ Key components to building better breakout strategies faster than ‘normal’

✓ Key components to building better breakout strategies faster than ‘normal’

✓ The most common mistakes breakout traders often make that costs them money – don’t let these catch you out

✓ How to choose the best markets and timeframe for quicker and more consistent results

✓ The shockingly simple technique to fast-track your breakout trading progress in just days

![[VIDEO] Why do You trade?](https://bettertraderacademy.com/wp-content/uploads/2019/02/11.feb19v2-min.png)

![[VIDEO] Can I make money every month in trading?](https://bettertraderacademy.com/wp-content/uploads/2019/03/21mar19-min.png)