So called ‘Rules of Thumb’ are very popular in the world of trading, investing and personal finance.

You probably know about the 2% rule.

You may have also heard of the Rule of 72.

How about the ‘120 minus your age’ rule?

These types of principles can be useful. But they need to be treated with caution. They often apply to very specific situations.

And when you apply them in the wrong way, they can do more harm than good.

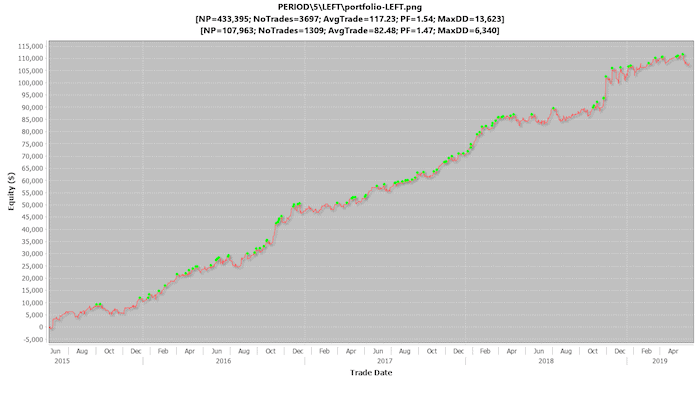

We recently conducted some research that tested a widely accepted principle about diversification. The hedge fund legend Ray Dalio popularized the principle, which gave it even more weight.

We discovered that when it comes to algorithmic trading systems, applying this principle does more harm than good. And we discovered the right way to use diversification to produce far more predictable results.

This is just as true in trading as it is in sports.

I’m sharing the results of this research in the August issue of the “The Empowered Trader Club.” You will find out why diversification is completely different for traders and investors, and the proper way to use diversification as a trader. I’m also sharing the massive difference I discovered between the effect of position-sizing and system-sizing on correlation and performance.

If you’re already a member of the Empowered Trader club, look out for your copy of this issue in the first week of August.

And if you’re not an Empowered Trader Club member yet (or don’t even know what it’s about), you can find more details here.

Happy trading,

Tomas