Let me break a myth.

The myth of ‘less is more’.

The myth that a good trading strategy needs to be simple.

Last week my hedge fund partner in charge of client acquisition had an important meeting. It was a meeting with the boss of the trading division of a big Czech bank.

From what I heard, the meeting was tough. And there were many objections. Even despite our extraordinary and fully audited results.

One of the objections was this:

How good can our trading strategies really be if they sometimes use up to 6 optimization inputs?

From a perspective of one of the bank’s trader, more optimization inputs mean more complexity. In his eyes, this means a higher chance of failing in live out-of-sample trading. (Which I disagree with and I’ll show you why in a minute).

Want MORE? Sign up for the free BTA newsletter and join 1000’s of other traders who receive meaningful trading content every week, straight into your email inbox. Click here to join us.

Of course, I’m already used to this dogma of “less optimization inputs = better and more reliable trading strategies”. So I equip my partner with a study to show this is not necessarily the case.

This was a study we did in our hedge fund some time ago. (And I’ve already shared it on my personal trading blog www.SystemsOnTheRoad.com too).

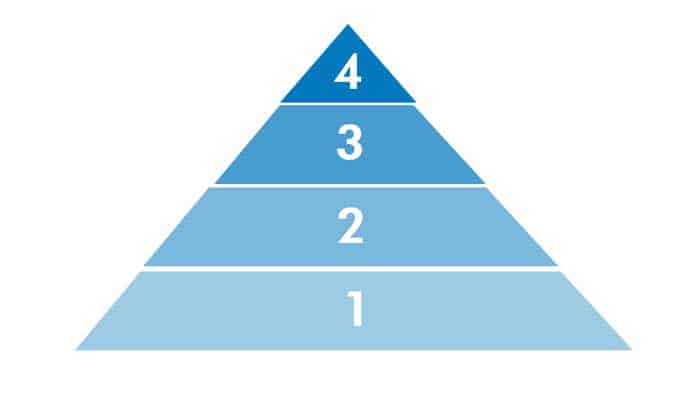

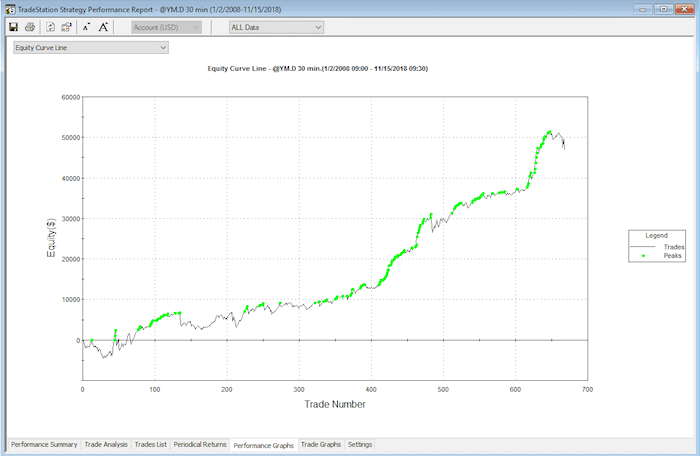

In this study, we used 700 strategies (at the time) from our strategy database. We built all of these strategies on futures markets. They included both intraday and swing strategies. And all also passed either Robustness Level 2 or Robustness Level 3 (a concept I teach in the Breakout Strategies Masterclass). Plus, most of them already had AT LEAST 1 year of true out-of-sample performance.

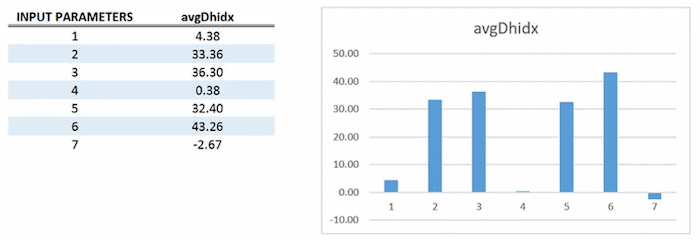

Then we created a proprietary index to measure overall strategy performance (we call it avgDhidx). This index combines some common metrics, like Net Profit, TradeStation Index and Profit Factor. The higher the avgDhidx, the better the performance.

Then we divided all 700 strategies into 7 groups, based on the number of optimization inputs (1-7), and calculated the avgDhidx index for each group. Of course, we used out-of-sample data only.

Our intent was to find out if there was some relationship between the number of optimization inputs and the quality of the out-of-sample performance.

And here are the results:

It’s pretty easy to see some obvious tendencies:

- The simplest strategies, with one optimization input, did NOT do better than strategies with 2, 3 or even 6 inputs.

- Even strategies with 2 optimization inputs did NOT do better than those with 3 or even 6.

- The whole range from 2 to 6 seems to work reasonably well. (The number 4 is an anomaly we need to investigate further, but the sample size of this group was pretty small too).

So, does less optimization parameters and ‘less complexity’ mean better trading results?

At least in the case of our 700 robust trading strategies, nothing suggests that is true.

My humble opinion is that markets are too complex today to have just “simple-stupid” strategies to beat them.

We need to be smarter.

We need more sophistication.

So, don’t just blindly follow the common trading beliefs because someone else says it’s true.

Always verify them for yourself first.

Happy trading!

Tomas and Andrew

P.S.

Then, naturally, there are other questions on how to work with optimization inputs properly:

How should we set the optimization ranges and steps?

What fitness function should we use?

What kind of optimization method is the best?

How many iterations is acceptable?

And then, after we figure all of this out, what’s the best way to regularly re-optimize all these input parameters?

Of course, I share all of this in the Breakout Strategies Masterclass too.

7 Proven Tips to Build Profitable Breakout Strategies FAST

✓ Key components to building better breakout strategies faster than ‘normal’

✓ The most common mistakes breakout traders often make that costs them money – don’t let these catch you out

✓ How to choose the best markets and timeframe for quicker and more consistent results

✓ The shockingly simple technique to fast-track your breakout trading progress in just days

![[VIDEO] If you’re not trading gold, you’re missing out](https://bettertraderacademy.com/wp-content/uploads/2019/04/5apr19-min.png)

![[VIDEO] Trade with this higher perspective](https://bettertraderacademy.com/wp-content/uploads/2019/05/13may19-min.png)

![[VIDEO] 71 life-changing trading tips for FREE](https://bettertraderacademy.com/wp-content/uploads/2019/05/20may-min.png)