Do you remember those ‘Apple vs PC’ ads on the TV in the 1990s?

They were a funny but very effective look at the differences between 2 competing options, and they ignited a debate that continues on today.

Everybody has their opinion on which is better, but the answer usually comes down to what you want to do with it.

And we can often see the same in trading software.

A HUGE part of successful trading is being able to execute and monitor your trading strategies effectively.

But to do that, you need to make sure you’ve got the right software, infrastructure and processes in place.

These days we’re spoilt for choice with trading software. Knowing which is best for you can also come down to ‘what you want to do with it’.

So, on this podcast episode we’re answering a listener question on software, execution and monitoring. Here’s what you’ll discover:

- The two types of strategy monitoring and what software you can use to easily apply them in your trading,

- Our top tips to always be on top of your execution platform,

- Critical steps you need to take to make sure your portfolio is running smoothly,

- And much more.

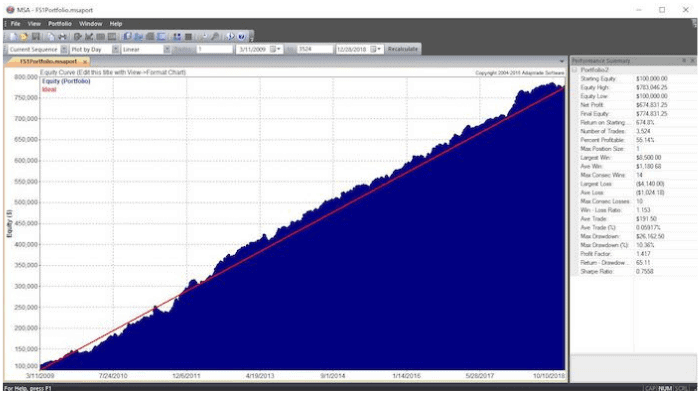

“We aim for 50, or even 100 strategies, just for the sake of having the luxury of creating the best possible portfolios.” - Tomas Nesnidal Click To Tweet “If you want to upgrade or manage your portfolio actively, that means swapping strategies each 12 to 15 months. That’s why we want to have a lot of great strategies, plus have a contingency plan in case anything happens.” - Tomas Nesnidal Click To Tweet “I think it’s pretty handy to have your execution platform on some remote server that you can access remotely.” - Tomas Nesnidal Click To Tweet “For performance monitoring, I highly recommend doing Monte Carlo analysis, and having an idea what are the worst possible scenarios for each strategy or portfolio.” - Tomas Nesnidal Click To Tweet

Resources:

– If you’d like to learn more about the Breakout Strategies Masterclass, you can get your enlightenment here.

Do you have any trading questions you’d like answered? Submit them here, and we may cover them in a future episode!

![[VIDEO] How to build strategies upside down](https://bettertraderacademy.com/wp-content/uploads/2019/03/18mar19-min.png)

![[VIDEO] How to build the life you want](https://bettertraderacademy.com/wp-content/uploads/2019/04/22apr19-min.png)