We all know this pretty well:

A breakout trade in an established trend is triggered.

Everything looks really great – the markets are trending and momentum is in

place.

But as soon as you enter…

… prices reverse immediately and within minutes hit your stop-losses.

Welcome to the painful, frustrating and unforgiving word of false breakouts.

I’ve spent thousands of hours researching false breakouts, as they were costing me a lot of money, patience, and frustration.

Want MORE? Sign up for the free BTA newsletter and join 1000’s of other traders who receive meaningful trading content every week, straight into your email inbox. Click here to join us.

So, I started asking questions…

Where do false breakouts come from?

What is the main reason for them to occur?

What is the weak part of a strategy, if it starts producing too many false breakouts?

And I discovered a key problem, a “universal truth”:

It’s all about timing.

If we can find a way to take an existing breakout strategy and improve its timing – then we can reduce false breakouts and start enjoying better performance, with a lot less stress and frustration too!

“If we can find a way to take an existing breakout strategy and improve its timing, then we can reduce false breakouts and start enjoying better performance” Click To Tweet

But timing can be really tricky, especially if we want to improve it without impacting strategy robustness (or increasing the danger of overfitting).

Fortunately, there’s a way.

“Timing breakout trades to avoid false breakouts can be really tricky… Fortunately, there’s a way.” Click To Tweet

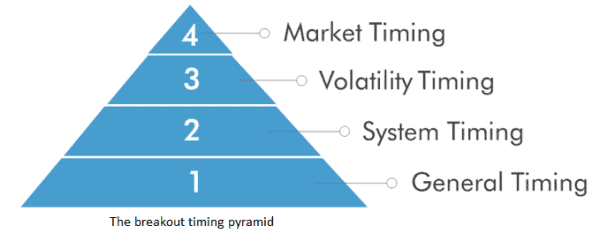

My work started out with identifying different types of timing. After endless testing, I found out that there are four key levels of timing that can be used to significantly smash false breakouts and I’ve put them into a simple pyramid:

GENERAL TIMING- This is the easiest to improve and there are some simple, powerful techniques that you can implement in under 5 minutes and smash a lot of false breakouts, with minimum risk of overfitting.

SYSTEM TIMING- Moves one step further and starts digging into the components of the strategy itself. It takes a bit of patience, but there are some simple but powerful tricks for improvement, with little risk of overfitting.

VOLATILITY TIMING- This is a very tough but important one, as volatility can decide everything. It took me a while to figure this out and what you basically need is a clever, unique way to assess different levels of volatility and then figure out what to do with each type of volatility, to smash many false breakouts.

MARKET TIMING- Is the last level and the most advanced. You first need to figure out a way to reliably assess different market qualities and then use them to remove a lot of false breakouts.

Now – would you like to know more, including details of the techniques available in each level?

Then we have a big announcement for you!

In Better Trader Academy, we’ve decided to take all my very best techniques to smashing false breakouts (from all four levels of the pyramid) and convert them into a very unique, highly practical course, so that you can start smashing false breakouts easily and quickly too!

All the techniques are in addition to an existing breakout strategy, so, whether you have your own trading breakout strategies or are a student of our ‘Breakout Masterclass’ or the ‘E-mini breakout strategies’ course, this will work perfectly for you, as a new layer of improvement.

If you want to know more about how to smash false breakouts fast…

– sign up here and wait for more information soon!

Happy trading!

Tomas and Andrew

7 Proven Tips to Build Profitable Breakout Strategies FAST

✓ Key components to building better breakout strategies faster than ‘normal’

✓ The most common mistakes breakout traders often make that costs them money – don’t let these catch you out

✓ How to choose the best markets and timeframe for quicker and more consistent results

✓ The shockingly simple technique to fast-track your breakout trading progress in just days

![[VIDEO] A crisis might be coming and I’m excited](https://bettertraderacademy.com/wp-content/uploads/2019/01/7.jan2-min.png)

![[VIDEO] The 3 letter word that could be holding you back](https://bettertraderacademy.com/wp-content/uploads/2019/04/15apr19-v2-min.png)

![[VIDEO] Embracing the unknown](https://bettertraderacademy.com/wp-content/uploads/2019/05/23may19-min.png)