We had a HUGE fire not far from our house last week.

Helicopters were flying past one after another. They were trying to access a pretty remote area and kill the fire before it spreads to the town. 177 firemen were involved and over 50 people were evacuated.

It looked really dramatic. And even though it was still a safe distance from our house, our terrace floor was completely covered with ash. That shows how strong the fire was.

A huge area of forest was totally burned. And that makes me said.

On the other hand, I know how the Spanish will deal with this: Soon they will plant new trees through the entire burned area.

So, new life will grow there again soon.

Now, the reason I’m sharing this with you is, that even in trading I’ve experienced a few ‘burned to ash’ situations during my career. Here’s a few random examples:

- About 13 years ago, when my very first discretionary daytrading strategy based on RSI divergences started falling apart, I had to abandon it completely and start over. At that time, it was like watching one of my favourite things ever get burned and buried forever. (After that I had to develop a completely NEW discretionary daytrading system, test it properly, paper-trade it for months first, and then put it into live trading).

- After 2008, I had to completely burn all my non-directional option strategies and start over, with a smarter approach, that wasn’t so sensitive to big volatility increases.

- In 2009, I had to completely stop my statistical arbitrage trading, as the edge had diminished from the markets and the profits were close to zero. All of that after years of thorough and expensive research.

- In 2010, my very first algo-strategy development and robustness testing framework didn’t work as well as I anticipated. I had to ‘burn it to ash’, go back to the drawing board and start over again. (Then the second version was developed, which already worked pretty well. And finally, after another few years, it has been perfected into version 3.0, which I now use in my hedge fund and teach in the Breakout Masterclass).

- Around 2013-2014, I teamed with an extremely talented programmer to develop a unique risk-management tester to discover brand new risk-management approaches in trading. After more than a year of heavy coding and testing, ALL the ideas failed. None of them worked. We had to burn the whole project to ash and start over again. (Fortunately, a different idea out of this failure emerged and that finally was THE idea we built our unique risk-management platform on. And then we launched our hedge fund with it).

- And finally, this year, we had to burn into ash a portfolio that made a lot of money for our hedge fund last year. It was too volatile for our main institutional client. And we had to start over, to create a way less volatile portfolio, with a much smaller annual return target. (Fortunately, this major client of ours keeps investing a lot of money with us, so it was definitely worth it).

And I could go on and on – there were definitely much more similar cases during my trading career.

Now, is this frustrating?

ABSOLUTELY.

But there’s a good part to it too.

And it is…

…burning the “old” to ash ALWAYS often precedes something NEW and MUCH BETTER arising next.

Each time this happened to me, it simultaneously cleaned the path to something new – despite the pain. It pushed me to see new angles and opportunities I did NOT see before.

So, sometimes it’s right not to be too attached to the old.

In fact, trading taught me to not be attached to anything – because attachment prevents fast growth.

So, do not feel discouraged if you find yourself in a similar situation, where all your hard work seems to be “burned in ash”.

That’s just a momentary perspective.

I’m 100% sure that later on, something much better will arise from that ash and will make you an even better and stronger trader than ever before.

And if you’re looking for some inspiration to bring up something new and better into your trading right now, don’t miss the opportunity to sign up for the FREE Combination Screening online training and the FREE Smashing False Breakouts online training.

Happy trading!

Tomas

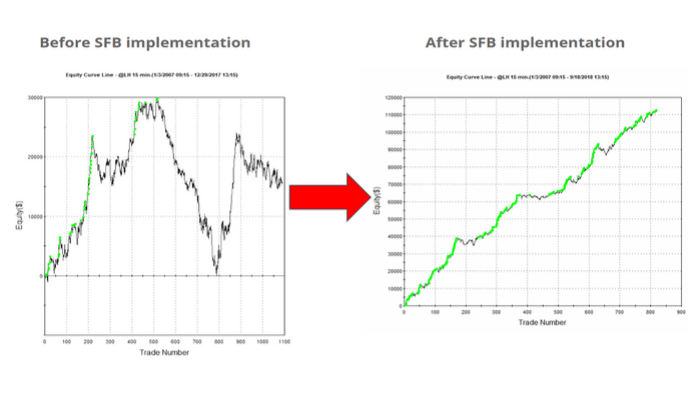

Stop False Breakouts from Destroying Your Trading Account

✓ How false breakouts are the biggest leak of money for breakout traders, including Futures, Stocks, FX and ETFs

✓ How much money false breakouts could actually be costing you – without you even realizing it

✓ A comprehensive deconstruction of timing – enter breakout trades at the right time and stop costly breakout trading mistakes

✓ 4 proven approaches to slashing false breakouts today – stop them from stealing your money and eating all your profits!