A few days ago I finished reading a book called “One Million Followers”.

It’s a book about how to get one million followers on Facebook in less than 30 days.

Now, I definitely don’t plan to start growing my Facebook following. (in fact, I don’t even use my private FB anymore, it’s full of crap).

But, I was curious to read if such a promise is realistic. If there’s even the slightest possibility to deliver on such a bold claim. And if so, how do they do it.

Because let’s face it – there’s so much hype nowadays. It makes sense to be skeptical and cynical and not take these claims seriously anymore.

Yet, I wanted to check the book out anyway.

And surprisingly… after I finished reading it…

… I became FULLY convinced that getting One Million Followers is a VERY POSSIBLE GOAL!

Of course, it would need a tremendous amount of work, but it seems it might still be possible to achieve.

Want MORE? Sign up for the free BTA newsletter and join 1000’s of other traders who receive meaningful trading content every week, straight into your email inbox. Click here to join us.

Now, here’s the funny part:

The trading industry is even more skeptical than the ‘building an online presence’ industry.

So if I ever wrote a book called “How to build 1,000,000 strategies under 30 days…”, nobody would read it.

Nobody would even believe it. (And I titled this post “How to build 1,000,000 strategies under 30 days…” as a joke).

I’m not saying it’s impossible – but even if it is, WHO CARES?

Who could ever need 1,000,000 trading strategies, right?

Yet…

I’m still a firm believer that you SHOULD definitely aim for at least 100 new trading strategies every 30 days.

Seriously – I mean it.

This is more or less the aim in our hedge-fund, because:

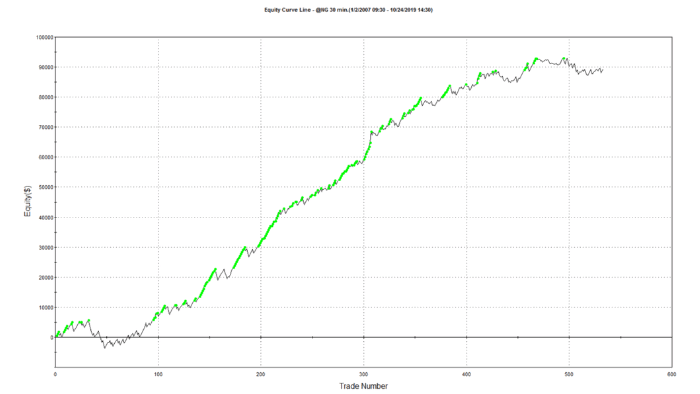

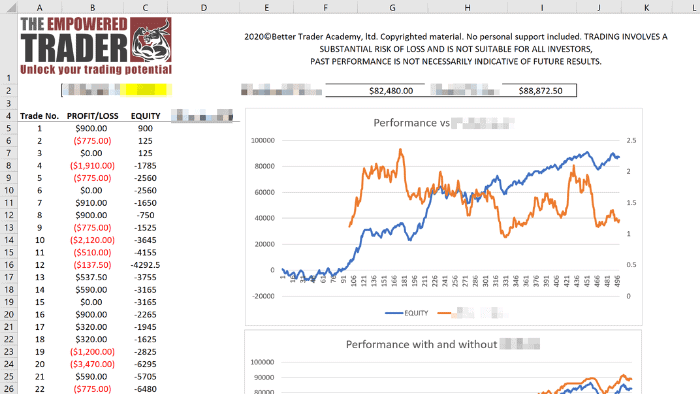

| 1. | The longevity of trading strategies is getting shorter and shorter every year. Forget having two or three trading strategies forever. In fact, our deep research suggests that optimal longevity is only 12-18 months. After this period, Profit Factor can start going down – and fast. |

| 2. | When we construct a small portfolio of 4-6 strategies in our hedge fund, we usually need 10-15 times more strategies to construct the portfolio “right”. Some strategies can’t trade together. And many other strategies don’t offer low correlation numbers you should be aiming for. So, to construct a small trading portfolio that’s good for steady income, you need LOADS of trading strategies to choose from first. (And I’m talking about a high quality, robust strategies). |

And finally…

| 3. | According to our research, you get much better Risk-Adjusted returns when you actively manage your trading portfolio. That means an active system of swapping your trading strategies throughout the year. And so you need a constant flow of new, fresh trading strategies. |

So, let me sum this up:

“How to build 100 strategies under 30 days…” is a goal that every serious algo trader should be aiming for. Every month.

There are proven techniques that make this much easier. Like the ‘combination screening’ approach we share in the ’14-day breakout challenge’ workshop.

And btw, needing to have a load of good trading strategies is actually a GOOD thing.

Because, until other traders realize the importance of this too, we have another nice edge over them. But we need to act now before they figure it out!

Happy trading!

Tomas

How To Start Creating Profitable Breakout Strategies In 2 Weeks Without Spending More Than 35 Minutes A Day

✓ The simple but incredibly powerful process to building profitable breakout strategies really fast,

✓ The 5 key components you need to create a good quality breakout strategy,

✓ How the power of automation can slash the time and effort you need to create loads of breakout strategies quickly and easily,

✓ How to tell if a breakout strategy is worth trading or is just over-fit rubbish,

✓ Start generating profitable breakout strategies in under 14 days without spending more than 35 Minutes A Day.