First of all, I realized that in our hedge fund, there are other ways to maximize our results. (Clue: Dynamic Position Sizing).

Second, I believe that a well-crafted portfolio will take care of the equity curve stability itself, even with lower win% trading strategies.

However, I understand that especially for beginning traders or traders with small accounts, it is pretty crucial to have a high rate of winning trades.

Fortunately, I used to spend a lot of time with this topic before having my own hedge fund too. And I certainly acquired a big amount of insights and know-how about this too.

So, how do you maximize your winning trades?

In essence, it is pretty simple: It all is about the right timing.

However… here is the trick:

It also is NOT.

Let me explain:

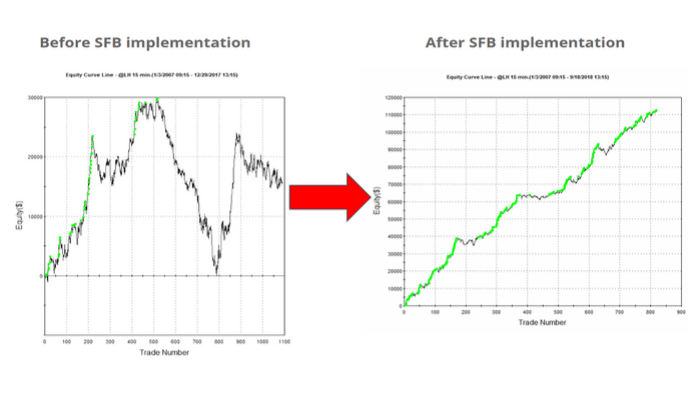

A lot of traders confuse better timing with FILTERS. From their perspective, the more filters they apply, the more they will be left with “perfect entries” only.

Of course, this is one big lie. All that’s really going on here is overfitting, which will look great in the backtest, but will be one huge financial disaster in live trading, potentially costing you a small fortune.

So, rather than thinking about filters, it is really about CIRCUMSTANCES.

It sounds like a small, subtle change, but in fact, it is a big shift in thinking (resulting in WAY better trading performance). And it goes like this…

The trading game is all about numbers and statistical probabilities. And it all goes in hand with something called DISTRIBUTION, which is NOT equal across the same market circumstances.

Markets have different qualities. And these market qualities always have a direct impact on the quality of your trades. So, in different market qualities, you will get different results. (In posh language, we say “there is a different distribution under different market circumstances).

So, to increase the number of your winning trades, you need to UNDERSTAND DIFFERENT MARKET CIRCUMSTANCES first. Then, you need to stop layering endless filters on top of each other blindly and assess your trading strategy in different market circumstances.

And finally, after that assessment, you need to trade the HIGHLY FAVORABLE circumstance only (or with more contracts). That will give you the maximization of your WIN%.

As you can see, the entire concept is logical and pretty simple. Of course, as always, the devil is in the details. And the right execution is everything – deciding your ultimate success.

So, if you are still not 100% sure how to do this, learn more about the right timing with my TIMING PYRAMID. Each level of this pyramid represents a potentially different set of circumstances. Your timing can be improved on many levels, not just one.

Watch the free online workshop sharing more about the right timing here.

Stay safe and happy trading.

Tomas

Stop False Breakouts from Destroying Your Trading Account

✓ How false breakouts are the biggest leak of money for breakout traders, including Futures, Stocks, FX and ETFs

✓ How much money false breakouts could actually be costing you – without you even realizing it

✓ A comprehensive deconstruction of timing – enter breakout trades at the right time and stop costly breakout trading mistakes

✓ 4 proven approaches to slashing false breakouts today – stop them from stealing your money and eating all your profits!