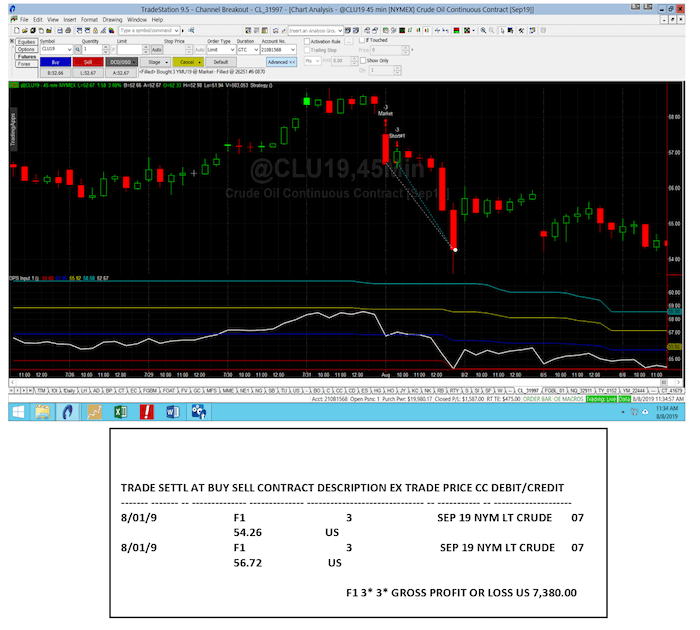

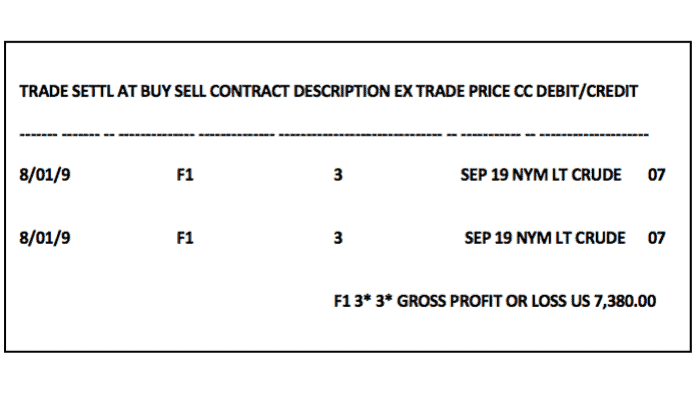

How would you like to make a profit of $7,380 on a trade with only a $500 stop loss?

That’s a profit of almost 15x your risk!

Sounds too good to be true?

Well it’s not.

A week ago we published a video case study called “How Lawyer Brian made +25,592 USD in live trading in the first 5 months.” (And NO, it wasn’t because of pure luck – watch the video to see how perfectly structured his trading portfolio is!)

Now, if you watch the video, you’ll also find out about his extraordinary 14.76R trade, where Brian actually made +$7,380 profit with just a $500 stop-loss:

Of course, you’re probably thinking:

“That was nothing more than pure luck.”

And I get it. But before you make such a rushed conclusion, keep reading. Because in this article, I would like to show you that it was NOT luck.

In fact, I would like to show you, that quite the opposite is the truth: These kinds of trades can literally become your NORM and you can create them DELIBERATELY. All you need to do is to implement a very simple technique (no tricks, no overfitting, no B.S.) and big wins with small risk can become your reality too.

But to fully understand what I’m talking about, let me start from the very beginning.

First of all, there’s one HUGE misunderstanding among many traders, that’s keeping them from potentially big financial rewards. In fact, for a very long time, I used to bite into this harmful misconception too, depriving myself of glorious trading wins. And I call this misconception…

The FALLACY OF OUTLIERS.

What do I mean by that? Well, it goes like this:

When traders see some huge winning trades in their backtests, they believe that these are just statistical outliers or the cause of overfitting, which will probably not happen in live trading. Thus, they exclude these big wins as ‘unrealistic outliers’ from the backtesting reports and pretend they were never there.

Now, don’t get me wrong. I’m not saying this is a bad thing. There are certainly good reasons to do this, and I alone encourage my students to take these precautionary measures in particular situations too. (Plus in certain cases, we even do this in our hedge fund). So again, no problem with this approach in general – except this small detail:

These are NOT statistical outliers.

It’s a fascinating thing and when I discovered it for the very first time, I was very perplexed. My mind was rooted in the obsolete ultra-conservative thinking that it’s “unsafe” to keep all the exceptional trades in our backtests and that we need to have a working system even when we exclude these trades from our backtest. All fair arguments – until I realized these two shocking things:

| 1. | These ‘outliers’ that I used to think were just luck or overfitting in my backtests, actually do happen in live trading – and often with a similar frequency than in a backtest, |

| 2. | These ‘ignored outliers’ can contribute as much as 50% of your annual returns! |

Now, I perfectly understand the rationale of why it STILL sounds clever to exclude them and not count on them in the future. Of course, we can be unlucky with our tech, miss 2-3 of them during the year, and be left with very little profit compared to what we were hoping for. And of course, it is AWESOME to have trading strategies working great even when we exclude these outliers, and yes, it IS a safer approach.

However, this still doesn’t justify treating these outliers the way we are taught and are conditioned to do so.

Not only can these be a GIANT boost in your trading income (and I mean a GIANT one), but if you’ve ever read the ‘Black Swan’ book by Nassim Taleb, you should already understand that:

| 1. | outliers, in general, should NOT be ignored at all (and this does NOT just apply to the risk-side, but also to profit side too – we need to treat them equally), |

| 2. | outliers are exactly what provided Nassim Taleb an enormous return in deadly 2008, so why on Earth should we be pretending we don’t see them and that they don’t count? |

So, a few years ago I decided to make a decision which is contrary to the trading herd and instead of ignoring positive outliers, I asked a game-changing question:

How can I EMBRACE these outliers?

And step by step, I started changing my whole thinking about them.

Want MORE? Sign up for the free BTA newsletter and join 1000’s of other traders who receive meaningful trading content every week, straight into your email inbox. Click here to join us.

First of all, I simply started COUNTING on them.

I stopped playing that silly game ‘if you’d miss THIS one trade your whole performance would be way too different’. To me, it’s BS, because trading is always about THAT ONE trade. You can’t be cherry-picking, and this applies to each side of trading. You can’t pretend that BIG LOSS in backtesting can never happen to you in live trading but count on that BIG WIN.

So, I implemented steps to minimize this risk of missing these blissful, abundant outliers – things like moving my trading to a broker, who actually supervises all the computer-generated trades and if anything happens, can enter manually (even with a small delay).

But second, and more importantly, I started thinking about what else is possible to embrace these outliers, and how to even MAXIMIZE the chances that these 10R+ trades happen more often. (By 10R+ I mean trades with 10 times or more profit than the initial risk/stop-loss).

And after a few years of thinking and experimenting, I found a viable solution (that we actually implemented into our hedge fund and that many BTA students are already using successfully, including Brian), and it is called…

‘Dynamic Position Sizing’.

It’s a very simple solution that ANYONE can implement (even in just a few minutes) and the premise of it goes like this:

| 1. | To me, outliers are big wins that were taken with small risk, so huge R-multiples like 10R, 12R or even 15R trades are occasionally experienced. |

| 2. | But if you think about it, experiencing high R-Multiple trades through outliers (meaning unexpected huge market movements and wins) is not the only way. |

| 3. | Another way to experience huge R-Multiples is by intelligently increasing your position while keeping the risk for the ENTIRE POSITION the same. So with 3 contracts, you now can increase your win 3 times, while keeping the same risk for the ENTIRE POSITION. |

| 4. | And that means huge R-Multiple trades can be DELIBERATELY CONSTRUCTED, thus huge wins with small risk can become your everyday reality. |

Now, how EXACTLY do you do it?

I reveal the method, step-by-step, in this free ebook.

It’s the same method that Brian used to trade for a +$7,380 gain with only a $500 stop-loss.

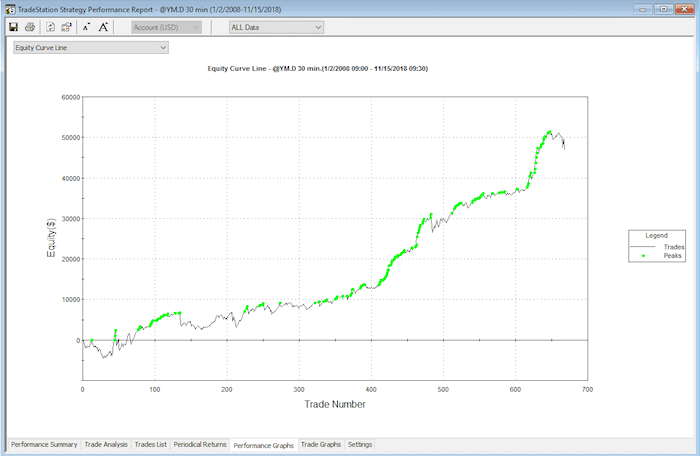

And it’s also the same method that helped my hedge fund make a +40% return in a SINGLE MONTH.

‘Dynamic Position Method’ is proven, and it works.

And I encourage you to implement it as well.

And embrace the outliers.

This new way of thinking about outliers and huge R-Multiple trades could totally change your trading.

Or at least give it an enormous BOOST.

Happy trading!

Tomas

How To Double Or Even Triple Your Profits

On Any Particular Trade?

✓ Discover how to boost your returns by manipulating the odds of specific trades in your favour,

✓ Implement the exclusive “D.P.S” techniques used by a private European Hedge Fund to increase risk-adjusted returns,

✓ With as little as 4 extra lines of code to implement fast.

![[VIDEO] How to improve trading entries](https://bettertraderacademy.com/wp-content/uploads/2019/02/22feb-video-min.png)

![[VIDEO] Trade with this higher perspective](https://bettertraderacademy.com/wp-content/uploads/2019/05/13may19-min.png)