Although we did make an enormous number of small mistakes, all of them were really just a necessary part of our growth and evolution – so I don’t regret any of them.

But there’s definitely one mistake I would never do again…

…and that’s accepting retail clients.

Now, to make this clear:

From the very beginning, we planned to design our hedge fund for a small group of private, very wealthy clients only. And on top of that for a few institutional clients, if they’d be ever interested (and to my surprise, their interest is growing every day). So it was not our mission to establish and run a hedge fund for retail clients anyway.

But, as it often happens in life, we broke this rule (often because of “friends of friends”) and accepted a few retail clients.

So, what’s so wrong with that?

Simply said, a retail client usually has an unreasonable perspective of risk versus reward. That’s the major and most challenging difference between a retail client and a private, wealthy client or an institutional client.

Whereas a private or institutional client understands that even a +10-15% return per year on average is a good return nowadays, and is even willing to accept equally high risk for such a return, the retailer client’s perspective is an annual return somewhere between +60% to +100%, with no risk whatsoever.

Now, don’t get me wrong:

In our hedge fund, we’re using some insane, cutting-edge proprietary techniques to make even a “retail client’s dream” possible. We manage our risk way beyond “normal”, with techniques like Market Internals, Smashing False Breakouts, and Dynamic Position Sizing.

And on top of that, our short history has already produced a very good track record (last year our CTA program return was among the top 5% of CTAs).

Yet, delivering outstanding results to retail clients is more of a curse than a victory.

Because once you achieve really good results – the retail client simply expects you to keep doing this nearly every day (yes, we even had calls from retail clients wondering why we had some losing days). And that creates a lot of unnecessary pressure and stress, which is not good for trading performance because it can potentially lead to a lot of unnecessary mistakes.

So, considering these circumstances, we decided to finish up with retail clients and focus on institutional clients only. Their ideal desired return is about +45% to +60% over a 3 year period, with an annual risk of about 15%. That’s a very achievable goal for us, with way less pressure and way more money under management.

So, what’s the lesson for you?

HAVE REASONABLE EXPECTATIONS AND DON’T PUT EXTREME PRESSURE ON YOURSELF.

I can’t stress enough how much poor performance is correlated with too much pressure.

If you have realistic expectations, you’ll be much more relaxed. And if you’re more relaxed, your trading will go much better. It’ll be much easier for you to keep producing stable, reasonable results.

Plus, don’t forget that techniques like Market Internals, Smashing False Breakouts, and Dynamic Position Sizing will take a lot of pressure off your shoulders too.

All these techniques have been proven by hundreds of traders already and will help you tremendously with achieving your own trading goals with much more fun and calm. So, I really recommend implementing them now.

Happy trading,

Tomas

Sick of long and painful drawdowns?

✓ 5-step framework you can use right away to improve your trading performance

✓ 5-step framework you can use right away to improve your trading performance

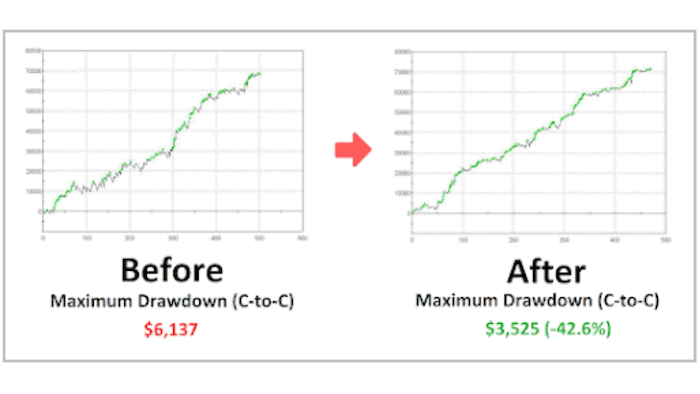

✓ A proven solution to slash drawdowns by up to 50%

✓ Applicable for index futures, stocks, and ETFs

✓ Quick and easy to implement

✓ You get the strategy code, so you can do it yourself!

![[VIDEO] How traders get high (without weed)](https://bettertraderacademy.com/wp-content/uploads/2019/07/8jul19-v2-min.png)