It was at the start of my trading career and I had no idea what I was doing.

I thought that all I needed to do to be a successful trader was to get some cool trading idea and then optimize it on past data.

Of course, I knew nothing about overfitting and curve fitting at that time.

So, I had to pay a bold ‘scholarship fee’ to learn my lesson.

Fortunately, it was all worth it.

After this (and a couple of more) experiences I became a “robustness-junkie”.

I decided to discover how to create the most robust trading strategies ever.

It took me a few years of heavy research and trading, but I finally did it. (And it was THE final step that gave me all that confidence to launch my own hedge fund too).

But the truth is, I don’t work with one robustness assessment only.

I’ve developed a bunch of robustness levels, which I call “Robustness Level 1” to “Robustness Level 3” (RL1 – RL3). Here’s how they work:

- RL1 is an ok strategy. But not a spectacular one. Nothing bad happens if you have one or two in your portfolio, but you better aim higher.

- RL2 is a great strategy. It’s like a Volvo car. Very robust, can survive a lot. This is my “baseline”. The majority of strategies in my trading portfolio should be AT LEAST RL2.

And then there is the third level.

- RL3 is an exceptional strategy. It’s a ‘robustness beast’. But it is also a very hard one to find. With my fast and fully automated strategy development, it can still take weeks.

Our ‘Breakout Strategies Masterclass’ students already know this. In the masterclass, they learn to follow my development and robustness testing process step-by-step (exactly as I do in my hedge fund). And they already know the patience that needs to be developed to come up with the occasional RL3 strategy.

But there’s always a shortcut.

The latest one was discovered by our student Alan (Al).

We introduced Al to you already, with his case study in the previous post “Surgeon revives a dying trading strategy”. (If you haven’t read it yet, you definitely should).

Al used the ‘Smashing False Breakouts’ techniques to prove that a failed trading strategy can be revived back to profitability… without overfitting.

And now, he’s decided to test the ‘Smashing False Breakouts’ (SFB) techniques even further. Specifically, to see if a RL2 Crude Oil trading strategy he developed in the Breakout Strategies Masterclass can be elevated to RL3 status using the SFB techniques.

First, Al tested all 14 SFB techniques again to find the most suitable one for the Crude Oil strategy. More about his testing procedure has already been described in the previous post.

Then he took the winning technique and implemented it into the existing RL2 Crude Oil strategy. (With the SFB techniques and code from the course, this can all be done in under an hour).

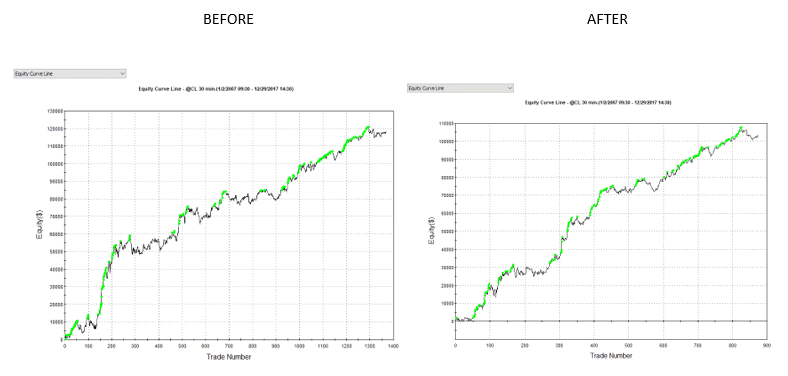

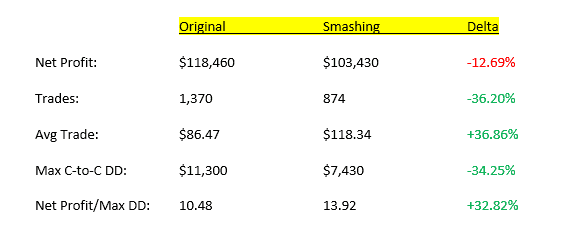

Here’s the difference before and after implementing the winning SFB technique:

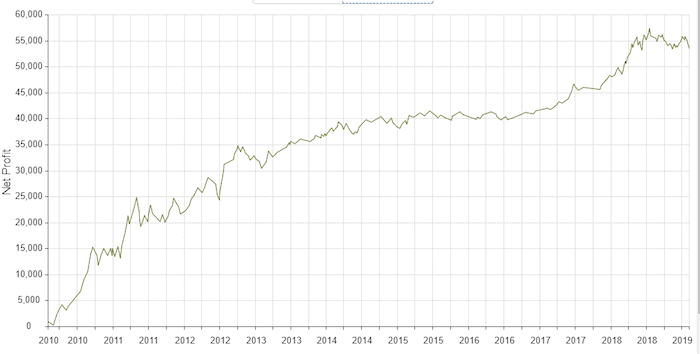

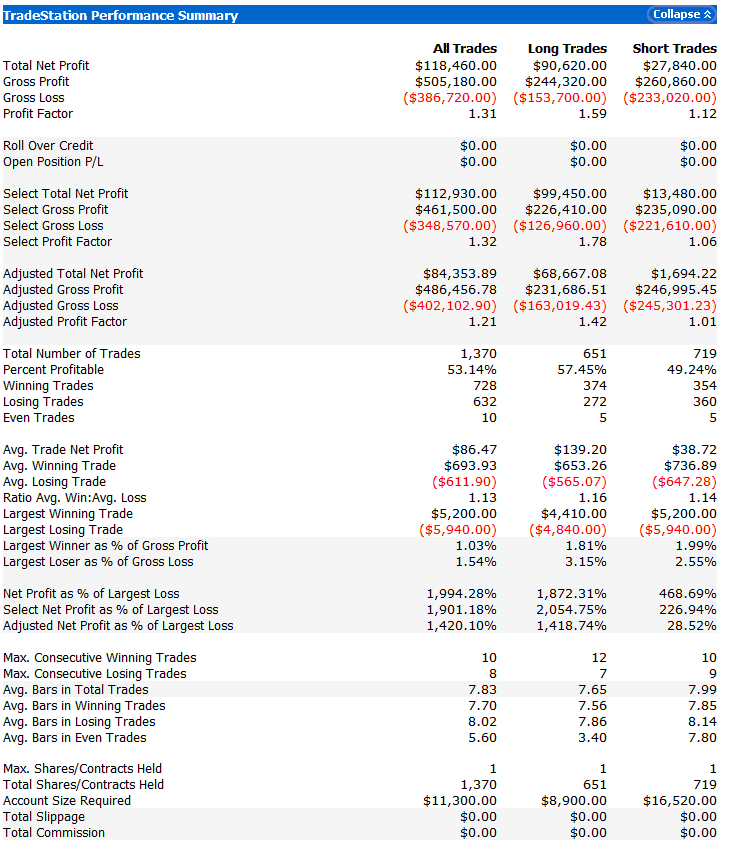

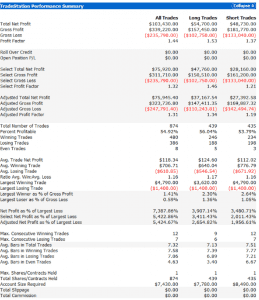

Here are the Tradestation backtest reports:

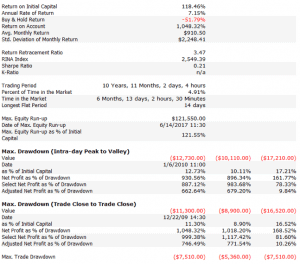

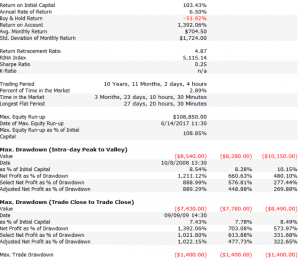

And here’s a summary of the improvements. (Drawdown reduced by 34.25%, Avg Trade improved by +36.86% and Net Profit / Drawdown ratio improved by +32.82%):

But the best is yet to come.

Of course, there’s always the danger of overfitting and over optimization.

Was the implementation of the SFB technique here such a case?

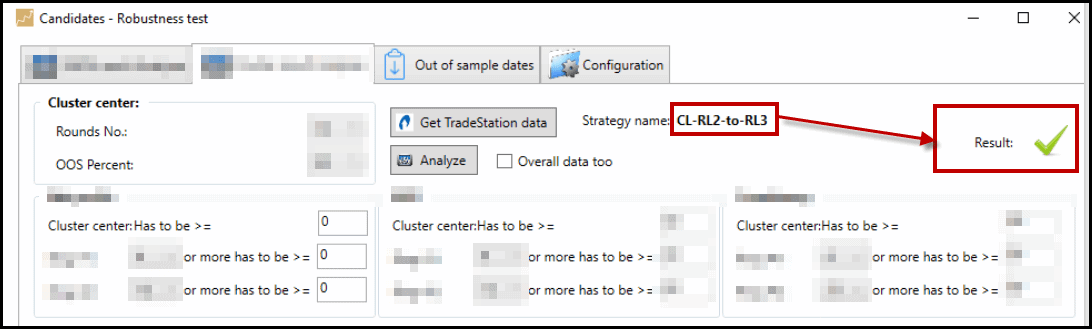

Al decided to take the improved Crude Oil strategy and run it again through the very extensive robustness testing procedures from the ‘Breakout Strategies Masterclass’.

To do this, he used the exclusive BOS Tool (a special app that is only available in the Breakout Masterclass).

And he even tested it for Robustness Level 3 (the original strategy was Robustness Level 2).

This time, the improved Crude Oil strategy passed RL3!

Source: ‘BOS Tool’ (a tool included in the ‘Breakout Strategies Masterclass’)

So, this great Crude Oil strategy turned into an exceptional strategy, with a very high (and rare) robustness level.

As Al shared in the previous case study:

“The Smashing False Breakout Method really works!”

Not only can it make your trading strategies perform better, but it can also increase their robustness.

Thanks a lot for sending us this case study, Al, and good work!

Tomas and Andrew

P.S.

We’re also preparing a podcast episode with Al where we’re going to extract even more details about his tests, watch out for it coming soon.

If you missed part 1, click here.

Stop False Breakouts from Destroying Your Trading Account

✓ How false breakouts are the biggest leak of money for breakout traders, including Futures, Stocks, FX and ETFs

✓ How much money false breakouts could actually be costing you – without you even realizing it

✓ A comprehensive deconstruction of timing – enter breakout trades at the right time and stop costly breakout trading mistakes

✓ 4 proven approaches to slashing false breakouts today – stop them from stealing your money and eating all your profits!