Last week I landed in Kuala Lumpur.

And the change of environment immediately gave me a significant boost of creativity, so I really wanted to take a full advantage of it.

And thus, I started working on a cool, new idea that I want to share with you.

But first, let me give you a brief overview.

3 years ago, when we first started modelling and drawing the whole framework and conceptual structure behind our hedge fund, we filled it with a lot of exciting ideas. Of course, over time, we’ve had to abandon many of them due to time challenges, complexity, costs, or too uncertain outcome.

But one thing that has been on our list for a long time, finally got to the realization last week.

It’s a new, advanced version of the concept we call “Market Quality”. (I already presented some directions in one of the Trading Market Internals coaching calls).

The idea is creating “complementary” strategies for different market qualities.

For example, creating breakout strategies for trending markets only. And mean reversion strategies for markets with strong exhaustion.

Or create different breakout strategies for low volatility and different for high volatility.

So, in essence, I think you get the idea:

Simply switching between different trading strategies and approaches based on the current market quality (MQ).

This idea alone is probably nothing new under the sun. However, the practical implementation is a very different story. It needs some thinking, creativity, and experience. Especially, if you want a high-quality solution.

For years, I had some fancier, more advanced ideas in my head, but last week it finally “clicked” altogether.

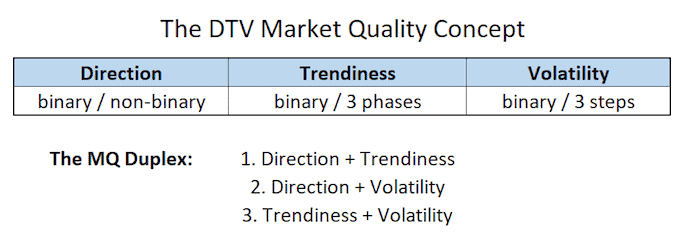

And the result is a new MQ model, which I call the “DTV Market Quality” model/concept:

The model is going to assess Market Quality based on 3 different inputs: Direction, Trendiness, and Volatility. (That’s where the ‘DTV’ name comes from).

First is the Direction of the trend. This was a really difficult one to figure out. I wanted to avoid a cheap solution like using Moving Averages because they are laggy and often don’t work very well. Plus I also wanted something without optimization inputs to avoid overfitting. And I wanted something more adaptive as well.

So, I came up with a few different solutions. One is based on cycles (a proprietary idea). Second on complex swing assessment (using our proprietary indicators). And third on Market Internals (basically many of the approaches I share in the Trading Market Internals program).

The Direction output will either be binary (1 = long, 0 = short), or non-binary (1 = long, 0 = no-direction, -1 = short).

Second is the Trendiness. This is how strong the trend is. Here I keep things simple, using some new approaches of ADX and DMI indicators. (Which I have a lot of great experience with). And as a second group, some Market Internals again. (Very reliable too).

Again, there will be a binary version (trend YES / trend NO) and non-binary version (trend initiation / trend maturity / trend exhaustion).

Third is the Volatility. I will use volatility bins, which I already shared in the Trading Market Internals and Smashing False Breakouts programs.

The binary version will just result in “Volatility YES and Volatility NO”. This will especially be important for the breakout strategies, which usually need volatility to bring in some profits. (Although, that is not a general rule of thumb. With many markets or breakout strategies, the opposite is true – low volatility can be a much better environment for breakout strategies, as a significant volatility breakthrough can be “just around the corner”. So it will be interesting to see what the future testing of the MQ Volatility will bring). There will be a non-binary version too (low vol / medium vol / high vol).

And finally, any two of the later will be able to combine into a “Market Quality duplex”.

The reason for using “duplex” only (instead of combining all 3 of them together) is:

- To keep things rather simple,

- To minimize the risk of overfitting,

- To keep significant sample size in each MQ state (or combination of the MQ states).

My preliminary testing has already shown that combining more than two elements would be too much. And too dangerous / overfitting-prone.

So, that’s what I have been working on since landing in Kuala Lumpur.

Unfortunately, I’m not allowed to share more due to my hedge fund’s Non-Disclosure Agreement, but in the future, I will certainly share some results.

Now back to testing.

Happy trading,

Tomas

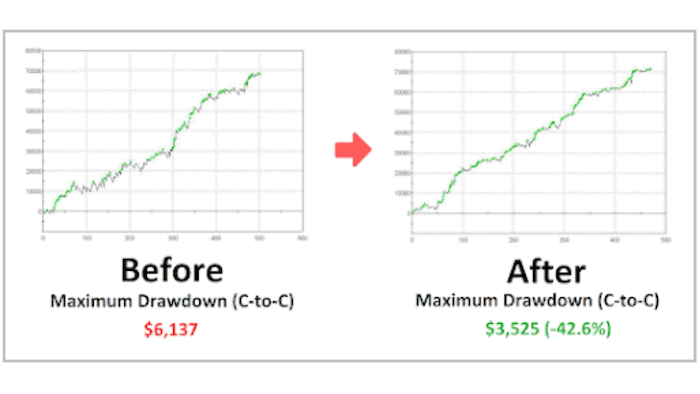

Sick of long and painful drawdowns?

✓ 5-step framework you can use right away to improve your trading performance

✓ 5-step framework you can use right away to improve your trading performance

✓ A proven solution to slash drawdowns by up to 50%

✓ Applicable for index futures, stocks, and ETFs

✓ Quick and easy to implement

✓ You get the strategy code, so you can do it yourself!

![[VIDEO] Beat the markets with better ideas](https://bettertraderacademy.com/wp-content/uploads/2018/06/Beat-the-markets-with-better-ideas2-1-min.png)

![[VIDEO] How traders get high (without weed)](https://bettertraderacademy.com/wp-content/uploads/2019/07/8jul19-v2-min.png)