At these meetings, people would bring printouts of hundreds of trading charts to ask my opinion of their analysis or trading ideas.

But I never cared about the chart itself, nor about the analysis.

My first response was always:

What is it that you see BEHIND this trading idea or analysis?

At first, people were a bit confused. They weren’t quite sure how they should reply.

But then, the brighter minds got it. They started describing the conceptual thinking BEHIND the idea or analysis.

Once they explained the conceptual thinking behind the idea, I asked another question:

And what’s behind that CONCEPTUAL THINKING that makes you have full TRUST in it?

Now even the bright minds seem confused.

But even in this small group of bright minds, there were a few who understood the question. Without hesitation, they replied:

Hundreds of backtests and simulations.

Now they got my attention – and I became more interested in their charts.

But about a year ago, I met a beginning trader and we went through the same chat. But this time something interesting happened…

He asked me:

“Now YOU show me some of YOUR trading charts.”

It surprised me a bit because as a fully-automated, algorithmic trader, I don’t care about charts at all. I care about research, statistics and probabilities.

So I thought about it for a moment, and then I told him:

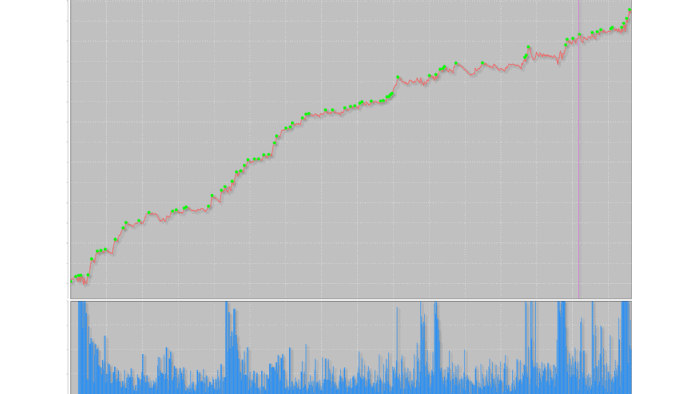

You know what? I am going to show you the trading chart that changed my life.

And I showed him this:

Yes, the guy was a bit surprised at first, not knowing what to think.

But then I explained to him:

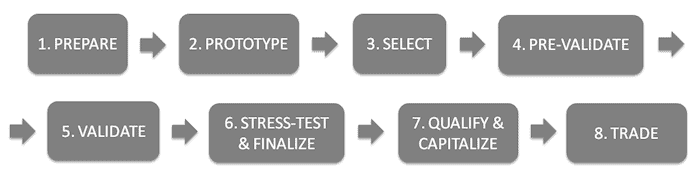

This is the process that took me many years to build, test, tweak and master.

But it is the exact process behind my trading charts, my trading entries, exits, profits, and my own hedge fund.

To me, this is the most important trading chart ever.

So, as you can see, successful trading is not about a single trading idea, strategy, entry or exit. It’s about many components. Components that need to be designed, researched, tested, tweaked and put into practice.

It’s also about how well these steps fit together. How smoothly and consistently one leads to other.

It is about seeing and implementing the bigger picture.

Happy trading!

Tomas & Andrew

P.S. Each step of the flow-chart above is explained in detail in the ‘Breakout Strategies Masterclass’. Including step-by-step implementation steps. With a bit of effort, you can implement it in just a few weeks.

7 Proven Tips to Build Profitable Breakout Strategies FAST

✓ Key components to building better breakout strategies faster than ‘normal’

✓ The most common mistakes breakout traders often make that costs them money – don’t let these catch you out

✓ How to choose the best markets and timeframe for quicker and more consistent results

✓ The shockingly simple technique to fast-track your breakout trading progress in just days

![[VIDEO] Can I make money every month in trading?](https://bettertraderacademy.com/wp-content/uploads/2019/03/21mar19-min.png)

![[VIDEO] Fear can make you a prisoner, hope can set you free](https://bettertraderacademy.com/wp-content/uploads/2019/03/25mar19-min.png)

![[VIDEO] Don’t use trading techniques as crutches](https://bettertraderacademy.com/wp-content/uploads/2019/06/10jun19-min.png)