Kids can be so sneaky… but they can’t fool me (this time).

Last week it was Halloween.

And as expected, there were a large number of costumed characters moving from door to door, collecting treats. But a group of three kids really stood out…

They had cooked up a grand scheme to get as many treats from unsuspecting neighbors as possible, with the least amount of work.

Here’s what happened.

These 3 cunning kids knocked on the door.

One was dressed in a zombie outfit, with a matching zombie mask.

The 2nd was wearing a black outfit with a scream mask.

The 3rd, well I don’t remember what it was, but it wasn’t as distinct as the others.

Anyway, they collected their treats and went on their way.

A few minutes later there was another knock at the door. It was a group of 3 kids…

But this time, one had a zombie outfit with a scream mask on.

The other had a black outfit with a zombie mask.

And the 3rd, well I don’t quite remember.

I looked at them for a brief moment, and I knew they were up to something. They had obviously switched masks and thought they would try to get more treats.

And I get why they did it. It was 34 degrees C that day (93 F in the old system), so it was HOT. And after all, who wouldn’t want to get as much as they can for as little work as possible? They were trying to “cheat” the system, and to be honest I don’t blame them.

Sure, it may not be fair, but you gotta give them points for trying. (And yes, I did give them more treats, but I let them know I figured out their game first and we had more than enough treats to go around.)

Thinking back at these opportunistic kids reminded me of a blog post Tomas wrote a few years ago, about “cheating in the markets”. He describes an opportunistic way to extract more from the markets, and who doesn’t want that? Here’s a quick reminder:

“Yes, it’s true… when it comes to the markets, I’m a cheat.

And with all honesty, I cheat a lot.

It allows me to get ahead of other traders and literally take their money.

But, I don’t call it “cheating” in front of others, because they may think badly of me, so I prefer to call it “An Unfair Advantage”.

Why is it unfair?

Because it allows me to extract more money from the markets while giving far less money back.

Curious to know how I do it?

One of my most favorite techniques is looking deep inside the markets like an x-ray, and extracting the ‘hidden’ data that tells me the TRUE strength or weakness in the market.

This data is invisible to the majority of traders.

They’re blind to it, so they don’t see the subtle clues about the market conditions until it’s too late.

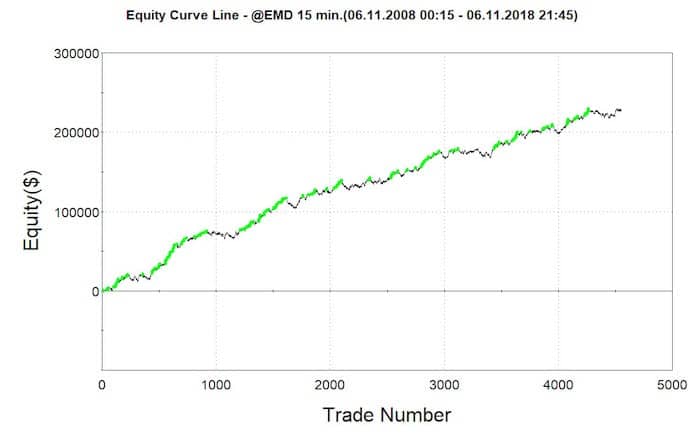

But it allows me to get in and out of trades before the majority of traders realizes the market has changed. I take trades only when the markets are in their best conditions, and I exit my positions and take my gains before the markets turn against me.

This often improves my returns while also reducing drawdowns.

Are you interested to discover more about this “Unfair Advantage”, including code and case studies comparing before and after?

You can download them now at Trading Market Internals.

Just check it out – but pssst, don’t tell anyone we’re cheating!”

If you want to find out more, you can get the treats at TradingMarketInternals.com.

Happy trading,

Andrew

Sick of long and painful drawdowns?

✓ 5-step framework you can use right away to improve your trading performance

✓ 5-step framework you can use right away to improve your trading performance

✓ A proven solution to slash drawdowns by up to 50%

✓ Applicable for index futures, stocks, and ETFs

✓ Quick and easy to implement

✓ You get the strategy code, so you can do it yourself!