As I was quickly scanning through the dozens of useless shows being broadcast, I stumbled on a documentary called “Capitalism: A Love Story” by Michael Moore.

The documentary was halfway through when I found it, but they were going through the crisis in 2008. When the markets were in free-fall, banks were going bust, and there was “blood on the streets”.

I remember that time well because it handed me a couple of painful but important lessons.

Want MORE? Sign up for the free BTA newsletter and join 1000’s of other traders who receive meaningful trading content every week, straight into your email inbox. Click here to join us.

In 2008 I was trading long-only mean reversion strategies in stocks. I was trading with leverage too, even while the market was dropping, so you can guess how my account fared…

I was slammed with big losses. Trade after trade. Day after day.

In fact the losses were so bad that I had to stop trading for a while. Not only did I destroy my trading account, but I took a massive hit to my ego (I was making really good profits just before the crisis and stupidly thought I was the genius who’d figured out the markets. Boy was I wrong about that – what a wake-up call!).

Anyway, it was a painful (but necessary) part of my trading journey, and seeing this documentary reminded me of that. For a brief moment, it ruined my night… but I’m glad it did. Here’s why.

As I continued to watch the documentary, they started talking about the issues that caused the 2008 crisis. And I realised that some of those issues haven’t really been fixed at all.

The “solutions” they employed to fix the issues, like QE and bailouts, haven’t really addressed the problems. In fact, in many ways we’re actually worse off now than we were back then.

That got me worried.

Worried about what might come next in the markets.

Worried about how that could impact my trading and the financial well-being of me and my family in the future. Especially for my kids.

In 2008, lots of people were ruined financially. People lost their homes. People lost their jobs. People lost their retirement funds, their investments and their financial security.

And while millions of people were suffering, either through their own poor decisions or the decisions of others, some people actually prospered.

I’m not talking about the companies on the receiving end of the bailouts (and juicy bonuses…), I’m talking about traders who were able to adapt. Traders who were prepared. The traders who had a plan and were ready for when the sh!t hit the fan.

And guess what?

Every day that goes by brings us 1 day closer to that next crisis.

We don’t know when it will happen. We don’t know how bad it will be. We don’t know how long it will last.

But it WILL happen, and this time it could be worse. Much worse.

That documentary really got me thinking, and I hope it also makes you think too:

- Are you prepared for the next crisis? What are you going to do when it hits?

- Where are the potential risks in your trading strategies, portfolio, risk management or position sizing?

- What can you do TODAY to be better prepared, to make sure you’re not financially ruined when the crisis finally arrives?

Listen, this may all sound a bit overdramatic, but it’s not. This is serious. People are still recovering from the 2008 crisis, more than 10 years later!

So, even if we take just 1 minute right now to think about these questions and assess where we’re at, it could go a long way to securing our financial well-being when the next crisis hits.

And here are 4 super-effective ways to prepare for and protect our trading portfolios:

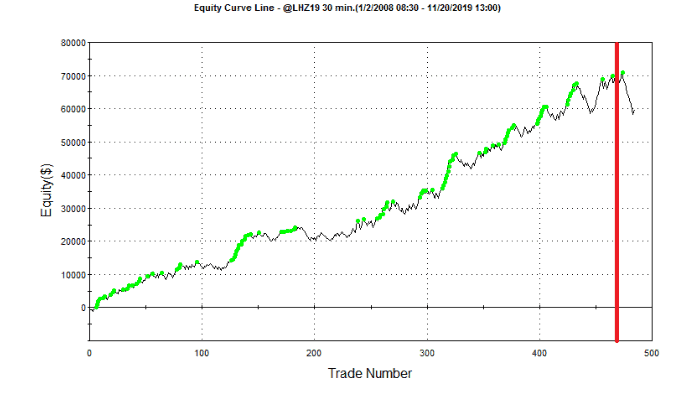

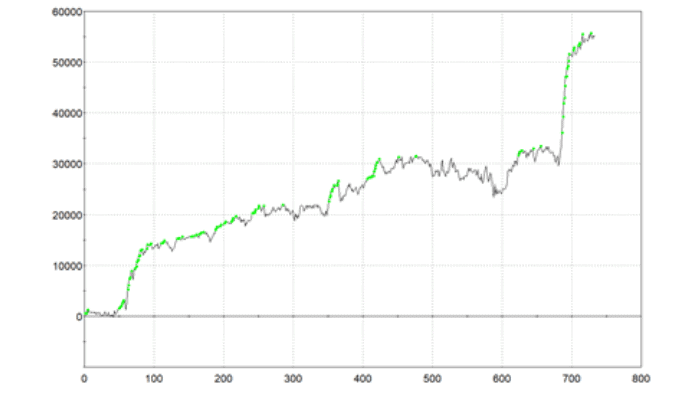

- Build a diversified portfolio of strategies that work in different market environments,

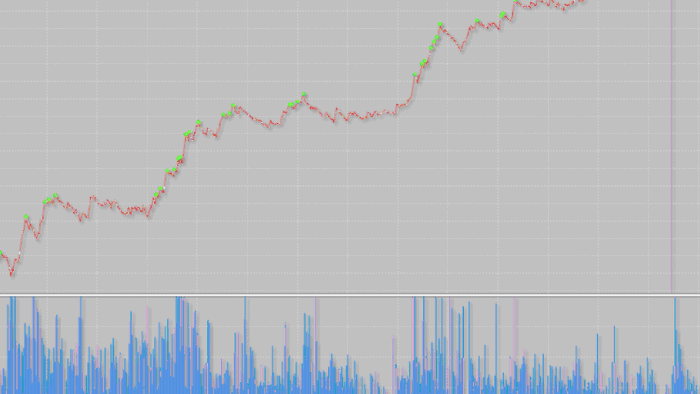

- Adapt your trading strategy entries to changing market characteristics and behaviours,

- Dynamically adjust your position sizing based on probabilities and market environments,

- Reduce drawdowns and adapt quickly to changes in the underlying mood of the market.

That’s 4 different ways to attack 1 HUGE problem.

I’ll be using everything at my disposal when the next crisis hits, I hope you’re prepared too.

The clock is ticking.

Andrew

How To Start Creating Profitable Breakout Strategies In 2 Weeks Without Spending More Than 35 Minutes A Day

✓ The simple but incredibly powerful process to building profitable breakout strategies really fast,

✓ The 5 key components you need to create a good quality breakout strategy,

✓ How the power of automation can slash the time and effort you need to create loads of breakout strategies quickly and easily,

✓ How to tell if a breakout strategy is worth trading or is just over-fit rubbish,

✓ Start generating profitable breakout strategies in under 14 days without spending more than 35 Minutes A Day.

![[VIDEO] How to SURVIVE the coming crisis](https://bettertraderacademy.com/wp-content/uploads/2019/08/12.aug-FI-min.png)