Trading crap still happens – and that is totally ok.

Although our hedge fund had a phenomenal year, there is one thing I’m not really proud of.

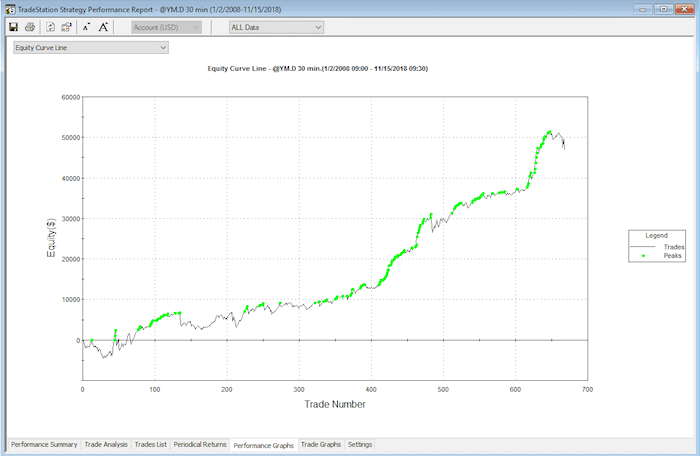

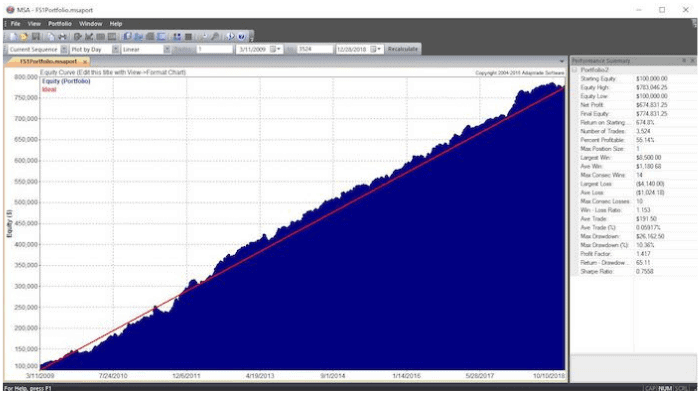

And it is this emini Dow Jones (YM) swing strategy:

Out of 15 strategies (5 in our CTA1 program and 10 in our CTA2 program), this is the only one that hasn’t worked so far.

Yes, it even lost some money and got pretty close to its historical drawdown.

It simply FAILED.

But listen:

That’s absolutely ok.

Firstly, it’s part of the game. You can have the very best and most sophisticated robustness testing procedures as I have, but you still need to be ready for occasional surprises like this.

Second, I want to show you realistically what trading is ALSO about, so you can have a REALISTIC perspective and expectations. And get yourself better prepared.

And third – who even cares?

Seriously.

Want MORE? Sign up for the free BTA newsletter and join 1000’s of other traders who receive meaningful trading content every week, straight into your email inbox. Click here to join us.

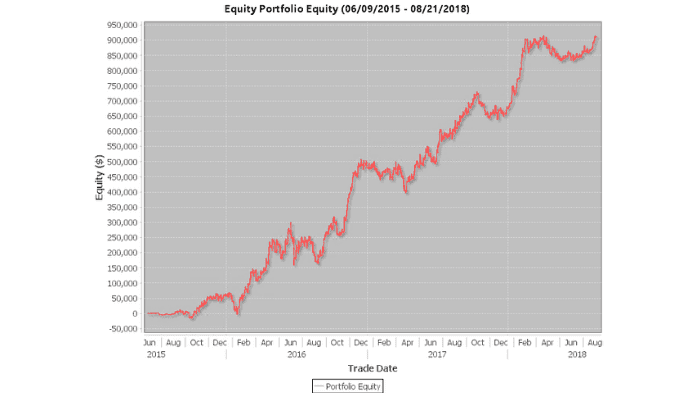

That’s why we traders need to learn how to think in terms of portfolios. (Instead of thinking in terms of single strategies).

Any more experienced trader already knows and will confirm with you, that a good, balanced portfolio can “absorb” occasional failures.

In other words, you can easily and confidently keep going with the occasional failing strategy, when you know this is just one out of 10 or 15.

And that is something we need to keep remembering again and again.

Am I happy about this failing YM strategy?

Of course not.

Do we need to replace the strategy for 2019?

Hell yes.

But do I freak out that crap like this keeps happening? Despite all of our tremendous research, super-robust framework, and exceptional robustness testing procedures?

No.

Not at all.

I simply go beyond the point of being too preoccupied with a single strategy and simply focus on the bigger picture.

‘Think BIG’, say successful people.

And for successful traders, that means ‘think big in terms of portfolios’.

A portfolio is your best safeguard against the times when occasional crap like this YM strategy happens.

So, work on your portfolio even harder than ever.

Happy portfolio trading!

Tomas

P.S.

If you still don’t have enough strategies to build a great portfolio, discover how to build them fast in this free 14-day trading challenge.

Or, join me in the Breakout Strategies Masterclass and learn how to think and grow even FURTHER.

7 Proven Tips to Build Profitable Breakout Strategies FAST

✓ Key components to building better breakout strategies faster than ‘normal’

✓ Key components to building better breakout strategies faster than ‘normal’

✓ The most common mistakes breakout traders often make that costs them money – don’t let these catch you out

✓ How to choose the best markets and timeframe for quicker and more consistent results

✓ The shockingly simple technique to fast-track your breakout trading progress in just days

![[VIDEO] How to build strategies upside down](https://bettertraderacademy.com/wp-content/uploads/2019/03/18mar19-min.png)

![[VIDEO] How to build the life you want](https://bettertraderacademy.com/wp-content/uploads/2019/04/22apr19-min.png)